stock option tax calculator uk

Enter the purchase price per share the selling price per share. NSO Tax Occasion 1 - At Exercise.

Get Your Personal Taxreturn Filed So That You Can Enjoy The Holidays Taxreturn 99 31st January Is Your Certified Accountant Tax Return Accounting

The first category is speculative in nature and similar to gambling activities.

. The Stock Calculator is very simple to use. You pay 127 at 10 tax rate for the next 1270 of your capital gains. This calculator illustrates the tax benefits of exercising your stock options before IPO.

You can deduct certain costs of buying or selling your shares from your gain. I went though a similar process last year with my stock options were forcibly exercised when we were acquired. Maximize your stock compensation gains and prevent.

Enter the purchase and sale details of your assets along with tax reliefs and our capital gains tax calculator will work out your tax bill including all tax rates. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. In your case where your capital gains from shares were 20000 and your total annual earnings were 69000.

The results provided are an. If the exercise price is 10 and you have 100 NSOs you would pay the company 1000 to exercise your 100 NSOs and the company would give you shares of stock. On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of.

The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. Poor Mans Covered Call calculator addedPMCC Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Learn how to trade options in the simplest way possible with my free options trading guide. As the stock price grows higher than 1 your option. Estimate how much your RSU value will increase per year.

Exercising your non-qualified stock options triggers a tax. Use this calculator to determine the value of your stock options for the next one to twenty-five years. If you have any queries about Share Options Tax Implications please contact Karen Robinson karenrobinsoncullenwealthcouk on 0161 975 6700.

By changing any value in the following form fields calculated values are immediately provided for displayed output values. Fees for example stockbrokers fees. Please enter your option information below to see your potential savings.

Enter the amount of your new grant - whether an offer grant or an annual refresh. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. 16000 - 15000 1000 taxable income.

How much are your stock options worth. To use the RSU projection calculator walk through the following steps. Input your current marginal tax rate on vesting RSUs.

Capital gains tax CGT breakdown. Locate current stock prices by entering the ticker symbol. You paid 10 per share the exercise price which is reported in box 3 of Form 3921.

Support for Canadian MX options Read more. Ordinary income tax and capital gains tax. Abbreviated Model_Option Exercise_v1 - Pagos.

The wage base is 142800 in 2021 and 147000 in 2022. IV is now based on the stocks market. This capital gains calculator matches in excess of 10000 share trades according to the Inland Revenues share matching rules.

The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent. You pay 1286 at 20 tax rate on the remaining 6430 of your capital. Enter the number of shares purchased.

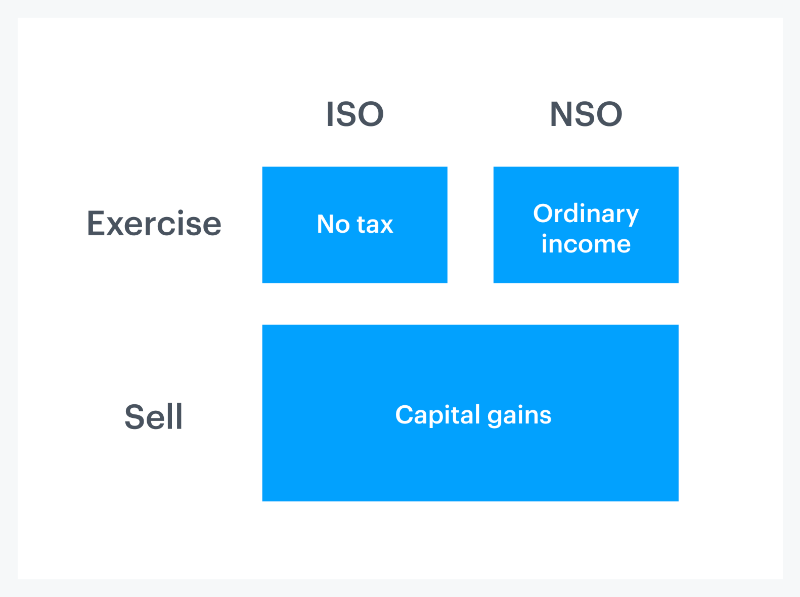

So unfortunately you will lose up to 40 in tax NI. There are two types of taxes you need to keep in mind when exercising options. If you fall under this bracket any day trading profits are free from income tax business tax and capital gains tax.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Click the view report button to see all of your results. Just follow the 5 easy steps below.

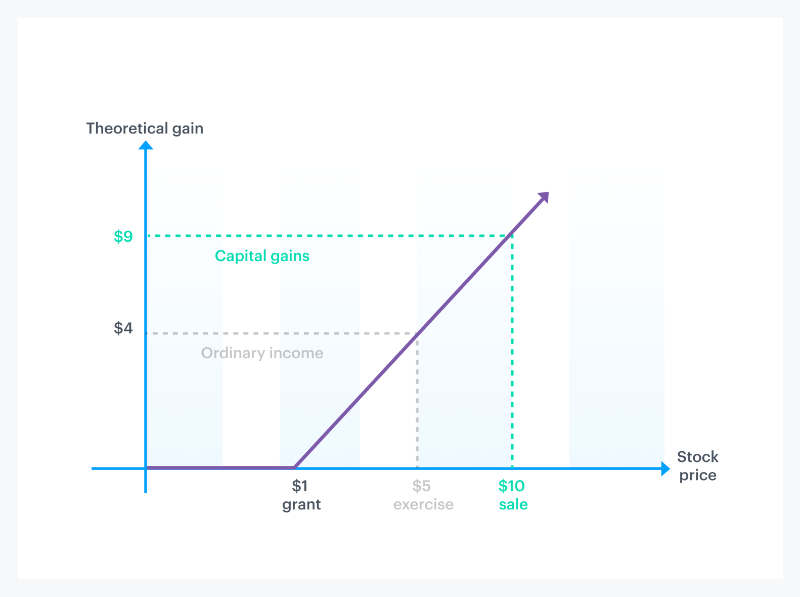

In our continuing example your theoretical gain is zero when the stock price is 1 or lowerbecause your strike price is 1 you would pay 1 to get 1 in return. Decide on your strategy. The Stock Calculator is very simple to use.

The Stock Option Plan specifies the total number of shares in the option pool. Stamp Duty Reserve Tax. Abbreviated Model_Option Exercise_v1 -.

So if you have 100 shares youll spend 2000 but receive a value of 3000. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. As you can probably imagine falling into this.

Enter the commission fees for buying and selling stocks. Check other pages for instructions. Important Note on Calculator.

If the scheme is unapproved then any money you make out of it is taxed as income from your employment at taxed at the normal rate NI. Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out. If youre considering offering UK employees stock options your HR and tax.

This permalink creates a unique url for this online calculator with your saved information. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. That means youve made 10 per share.

The options were granted within. Simply paste your trades into the box below and click the CALCULATE button. The issue of stock options under an advantageous plan should also mitigate any social security payable by both the employee and employer as compared to non-qualifying stock options.

You pay no CGT on the first 12300 that you make. Cash Secured Put calculator addedCSP Calculator. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share of company stock.

Taxes for Non-Qualified Stock Options. Alternatively if your trades are in txt or csv format then you can drag and drop or use file upload.

Iso Amt Tax Calculator Eso Fund Calculate Employee Stock Options Tax Or Iso Amt Tax Through Eso Fund Our Special Tax Write Offs Tax Deductions Filing Taxes

Excel Income Tax Calculator For Fy 2021 22 Ay 22 23 And Fy 22 23 Ay 23 24 Only 30 Second

Zek Co London Tax Services Accounting Services Bookkeeping

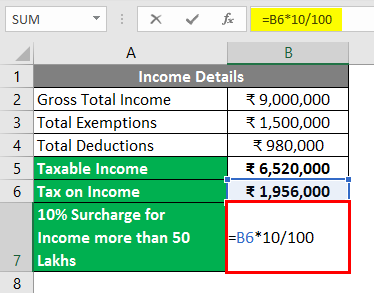

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

L 1 Visa Taxation Tax Withholding And Payroll Taxes

What Is The Formula To Calculate Income Tax

How Stock Options Are Taxed Carta

How To Calculate Pre Tax Profit With Net Income And Tax Rate The Motley Fool

How Stock Options Are Taxed Carta

Excel Income Tax Calculator For Fy 2021 22 Ay 22 23 And Fy 22 23 Ay 23 24 Only 30 Second

Mortgage Calculator Plus Mortgage Calculator Mortgage Calculator

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Capital Gains Tax Spreadsheet Australia Budget Spreadsheet Excel Spreadsheets Templates Spreadsheet Template

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Incentive Tax

Excel Income Tax Calculator For Fy 2021 22 Ay 22 23 And Fy 22 23 Ay 23 24 Only 30 Second

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

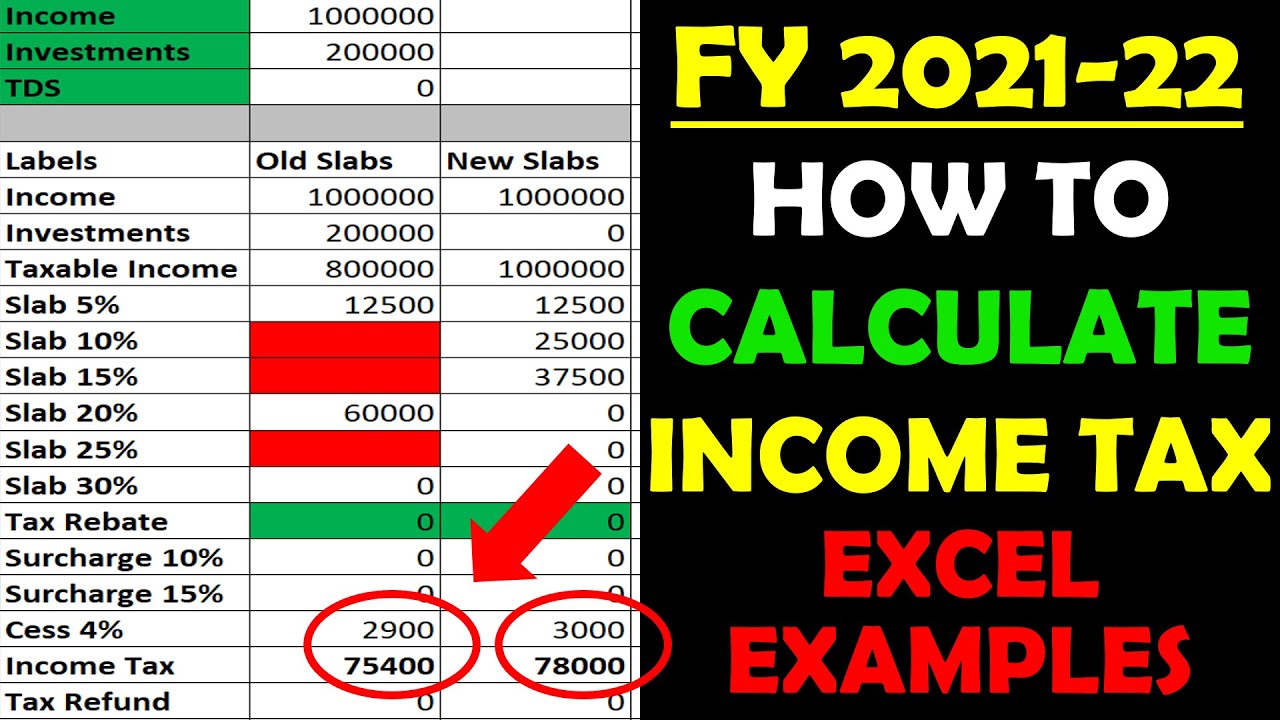

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube